If you’re feeling bereft about the state of the economy, you might be looking at the wrong headlines, according to ITR Economics Senior Forecaster & Senior Economic Consulting Speaker Connor Lokar. Then again, the data holds some daunting details about what lies five or six years down the road.

In his “Challenges and Opportunities” presentation during our recent reFRAME event, Lokar gave attendees good reason for optimism and laid out some hard truths about interest rates, the labor force, and where 20% of your tax dollars are going these days.

It’s Not All Bad News

“If I look at the hard data points,” Lokar said, “I really don’t see any data saying, ‘Jump off a cliff.’” What he sees could be described as glimmers of hope, which in part says something about the economic circumstances we’ve been living in for the past few years.

Noting that the economy expanding by 1.2% in Q1 2025 is “some of the best quarterly growth we’ve seen in over two years,” Lokar also pointed to industrial production growth as an encouraging sign. That growth? Half a percentage point annualized performance.

“You’re probably asking, ‘Are you really trying to get me excited about five-tenths percent growth?’” Lokar conceded. His answer: “I am! Because when I was here last year that number was negative.”

After 18-24 months where very few sectors saw growth, 0.5% is more than welcome. And it’s likely an indication of positive change.

“Our forecast is that the economy will still grow this year, despite trade wars, despite tariffs, despite conflict in the Middle East, despite uncertainty around tax bills,” Lokar said. “We think the economy can still grow despite all of that. I’m maintaining cautious optimism because the data is telling us that is the path forward.”

Still, Challenges are on the Horizon

“Volatility is not helpful,” Lokar said, referring to the current administration’s trade war. In general, ITR Economics—and Lokar specifically— advocate for minimal government intervention.

“We view government involvement in the economy with extreme skepticism,” he said. “When the government wades into the economy, they quite often exacerbate a problem or create an entirely new problem.”

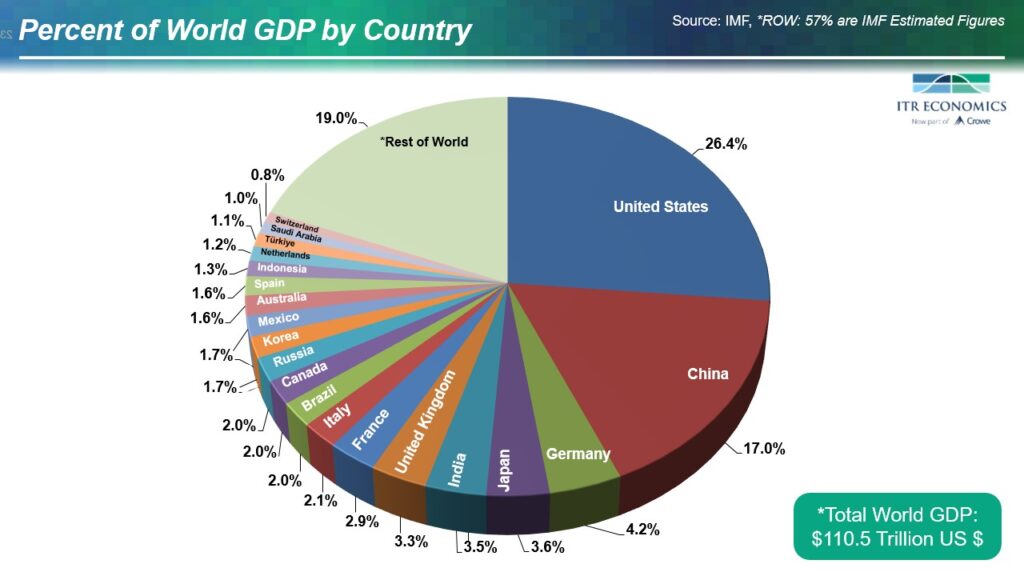

Most of the top global economies are “limping into 2025,” Lokar said, and the tariff situation is further obstructing economies here and abroad. And to what end? To that, Lokar showed the “very ominous-looking trend” of the U.S. trade balance for goods, which has dipped precipitously over the past 20 years as our imported goods have increased. Tariffs represent one way to stop that trend. Meanwhile, pointing to a pie chart of GDP by country, Lokar noted that “every country on this chart needs our consumers more than we need theirs.”

Here at home, interest rates present another hurdle: “Interest rates are not going to go down,” Lokar said. “Mortgage rates are not going to get back to four percent. Inflation is not going to go back below two percent. “

Inflation, he said, is “here to stay.” And, worse, federal spending increased by 13.1% in 2024, which is bailout-level spending growth. That troubling figure is a big part of why Lokar warns that the United States is likely to sustain another depression in the 2030s.

“We’ve got about four to five years of the economic sun shining before some very lean years,” Lokar said. So, if you’re putting off any kind of leveraged purchase, don’t: “You can’t afford to punt on this year because you’re reading a bunch of scary headlines. Anything you’re not buying today, you’re not doing yourself any favors by waiting.”

Important Points for the Year Ahead

With a tight labor environment that isn’t expected to change, productivity is essential. Investing in retention, training, and tools like AI can make all the difference.

Lokar left the group with a few recommendations for making the most of the next few years:

- Digitize and use AI: Embrace technology to drive efficiency.

- Maximize competitive advantages: Focus on what makes your business unique and strong.

- Diversify investments: Think about expanding the asset classes you’re invested in and be ready to pivot hard between 2028 and 2032.

- Manage costs and inflation: Margin pressures are real, so having effective cost management and inflation-savvy plans is imperative.

- Be USA-centric: Focus your thinking on the future within the U.S. context.

- Don’t hold out hope for a significant interest rate change in 2025: It’s not coming; plan accordingly.

- Expect higher prices: Wages, rents, power, and nationalism will contribute to increased costs.

- Build an inflation strategy: This is a critical piece of planning for the future.

Interested in learning more and taking a deep dive? You can watch Lokar’s entire presentation here.