The MJ Companies|

Cindy Archer joined the MJ team in 2007 as a risk transfer specialist in our Risk Management + Commercial Insurance department. In her role, Cindy works to coordinate service and marketing activities for clients, as well as managing data analytics to identify potential gaps in coverage and making recommendations on those limitations. On top of servicing the day-to-day needs of her accounts, Cindy and her team aim to provide clients with the best possible risk management solution to fit their individual needs.

Prior to joining MJ, Cindy worked as a multi-line claims adjuster for Erie Insurance. With over 30 years of industry experience in both the agency and carrier side of the business, Cindy has grown to become an expert in several fields. Her specializations include social services, recycling, and manufacturing, where she develops risk management strategies and programs tailored to her clients’ needs.

Related Blogs

Employer Response to Pharma Shifts

Chris AntypasVolatility in the pharmaceutical industry, including the expanding specialty drug pipeline, increased utilization of GLP-1 medications, and persistent supply chain disruptions, are contributing to rising costs ...

Read More

White House Launches TrumpRx, Unveils Drug Prices

DeAnn DeckOn Feb. 5, President Donald Trump announced the launch of TrumpRx.gov, a federally operated website to help individuals buy prescription medications at discounted cash ...

Read More

DOL Issues Updated Model Employer CHIP Notice

DeAnn DeckThe U.S. Department of Labor (DOL), through its Employee Benefits Security Administration (EBSA), has released a new model Employer CHIP Notice with information current ...

Read More

Prescription Drug Reporting (RxDC Report)

DeAnn DeckThe No Surprises Act (NSA), enacted as part of the Consolidated Appropriations Act, 2021 (CAA), includes transparency provisions requiring group health plans to report ...

Read More

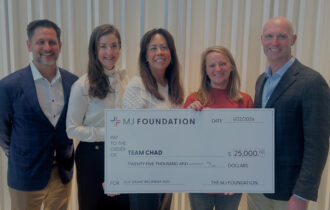

The MJ Foundation Awards $55,000 to Nashville Nonprofits Team Chad, Pathways Kitchen, and UpRise Nashville

Britni ShroutNASHVILLE (Jan. 26, 2026) – The MJ Charitable Foundation (the MJ Foundation) has made major gifts to three Nashville nonprofits as part of its ...

Read More

Major Federal PBM Reforms Enacted as DOL Proposes New PBM Fee-Disclosure Rule

DeAnn DeckFederal oversight efforts directed at the pharmaceutical benefit manager (PBM) industry have expanded in recent years, culminating in several significant actions. On Feb. 3, ...

Read More