Personally or professionally, everyone reading this almost certainly interacts with pharmacy in some way. There’s a lot of fear and concern at the present moment – not just among people who rely on prescription medications but those who make benefits choices on their behalf.

“The future is unclear, but your pen has a ton of power, and with that pen, you can materially influence the future of pharmacy,” MJ Lead Pharmacy Consultant Chris Antypas told attendees at our recent Swerve seminar. That power is essential now, while breakthrough therapies are coming rapidly and bringing greater unpredictability to costs.

Here are the areas where Antypas sees the most room—and need—for change.

Key Regulations: State and Federal

Medicare price negotiations enabled by the Inflation Reduction Act will undoubtedly put greater financial pressure on the commercial market, and removing the Medicaid rebate cap forced manufacturers to reduce drug prices for certain products, while also eliminating rebates Faced with shrinking losses on the public side, manufacturers are looking to bridge the gap on the commercial side.

As a result of these changes and the fluid nature of the pharmacy market, the contract you sign today with a PBM may be outdated in six months. Legislators are scrambling to address PBM reform, and Antypas pointed out that the 318 state bills under consideration jumped to 340 just in the few days since he put together his presentation. Indiana alone has 10 such bills.

Federal legislation on the horizon is sure to influence drug pricing, rebates, and vertical integration (wherein a single company controls health insurance, pharmacy benefit management, and pharmacy operations). PBMs are ready with changes to contract language and business models while manufacturers are looking for ways to work around cost-containment measures.

“We all need to buckle up for this,” Antypas said. “These bills are zeroing in on the fiduciary because the pharmacy industry is riddled with conflicts of interest. I encourage you to double-check your plan: If your PBM makes more money when you spend money, that’s a major red flag because they’re the one responsible for managing the plan and controlling your cost.”

“The industry will be forced to change because of the legislation coming.”

Shifts in Cost Containment

Keeping costs down means shifting the paradigm, Antypas said. Whereas the pharmacy benefit currently is viewed as a cost center, new possibilities arise when you look at it as an investment center.

At present, you’re probably still “negotiating” drug discounts with your PBM, despite the fact that pharmacies report their acquisition cost to CMS where it is aggregated with other pharmacies and reported as the national average drug acquisition cost (NADAC). Drug pricing is no longer a secret, but even though that information is publicly available, are you even using it?

“When it comes to brand medications, nobody really knows the net price because the drug-specific rebate is not disclosed,” he said. “What was the amount the manufacturer actually paid? You don’t know because it touches a few different hands before it gets to you.” And because traditional (big) PBMs are profiting off of rebates, they are fighting against rebate-related legislation. Your current PBM contract likely has a provision that gives the PBM the right to change the agreement to preserve the current economics (i.e. their profit) in the event of a relevant change in law.

“We want our clients to be able to say ‘No, I don’t accept your proposal and will terminate this contract,’” Antypas said. “We will discourage anyone from signing a contract that doesn’t have an out.”

But the bigger picture comes from making the shift to viewing your pharmacy benefit as investment, he said: “There’s really not a stakeholder in the supply chain right now accountable to the efficacy of drugs you all are paying for. We are crossing our fingers and hoping these drugs are working.” We’re doing this while everyone downstream from you – the plan sponsor – are profiting off of more and more utilization regardless if the drugs have a positive effect.

A JAMA study found that, of the estimated (and whopping) $935B U.S. healthcare spending that constitutes waste, $170B is tied to pricing failures, many of which involve pharmacy.

With no accountability and inconceivable waste, who has the power to change the system? You.

“The plan sponsor may be the most important role,” Antypas said. “You hold the pen. You get to decide on sticks or carrots in how the plan is designed and managed.”

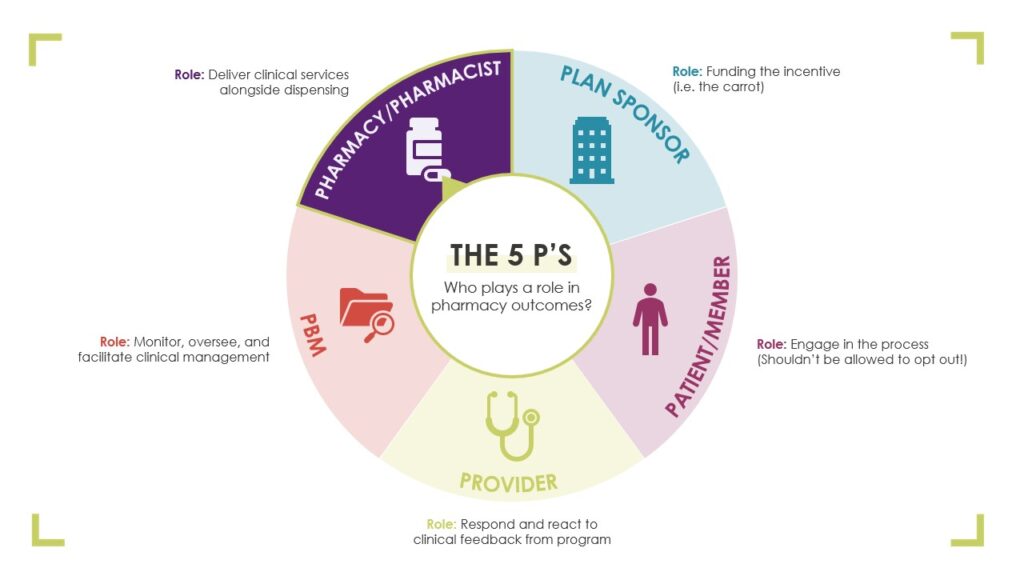

There’s room for improvement within the roles of all five stakeholders in pharmacy outcomes: the pharmacy/pharmacist, PBM, provider, patient/member, and plan sponsor.

Plan sponsors, he said, are in the best position to lead change: “You’re paying a lot of money to doctors and nurses, but your pharmacist is also a provider, and you’re choosing to let your PBM decide how you pay pharmacies. There are ways to pay pharmacies differently. And let me tell you, what gets rewarded gets done.

“Demand drives the market. If we sit across the table from our vendors and demand they solve for this and put it on the table, ‘We’ll fire you if you’re unable to solve for this,’ they’ll solve for it. There are solutions already in existence, but they will not do it unless you demand it.”

Using Data Strategically

Data can be used to understand what has happened, Antypas said, and it can be used predictively. The true difference-maker is using it predictively, so that you identify and prioritize risk management factors to tailor your strategy accordingly.

“The ability for AI to do things with big data we aren’t already able to do is unbelievable,” Antypas said. “How do we know this drug is the right drug? Formularies. You may want to pay for the more expensive drug if it has better outcomes data. AI can help.”

He urges using data to identify inappropriate medication use and medical correlations so you can meet these red flags with appropriate intervention, like patient education and medication therapy management, to get better results more cost-effectively.

Learn More

Watch Antypas’ full presentation to find more details about the concerns above and about next moves from HHS, plan compliance issues, and how to protect your own plan.

He’d tell you there’s good reason to do just that: “If we look at each other and say what we’re doing in health care right now is working, that’s dishonest,” he said. “Regardless of the political components, we could probably agree that significant change in how we’re doing things is in order.”